.png)

Carlos Romera Cano, Senior Director Fundamental Ratings Sales of Scope Ratings said: “We are delighted to welcome the National Bank of Greece to our growing client base. Securing this rating mandate is a significant milestone for our Financial Institutions franchise and further expands the reach and relevance of our public rating coverage. In these turbulent geopolitical times, it is also a clear signal in favour of European autonomy and sovereignty.”

Read the press release of the National Bank of Greece.

Scope rates the National Bank of Greece at BBB+/Stable. The rating reflects the groups’ well-established domestic franchise, alongside steadily improving financial fundamentals. Read the full rating announcement from 12 February 2026.

Scope’s sovereign rating on Greece was updated on 7 November 2025: Scope affirms Greece’s credit ratings at BBB and revises the Outlook to Positive

About National Bank of Greece (NBG): Established in 1841 as the first bank of the modern Greek state, NBG continues to play a pivotal role in supporting Greece’s economic development and social transformation. NBG today is a leading, modern financial group providing a comprehensive range of financial products and services to 6 million clients at home and internationally.

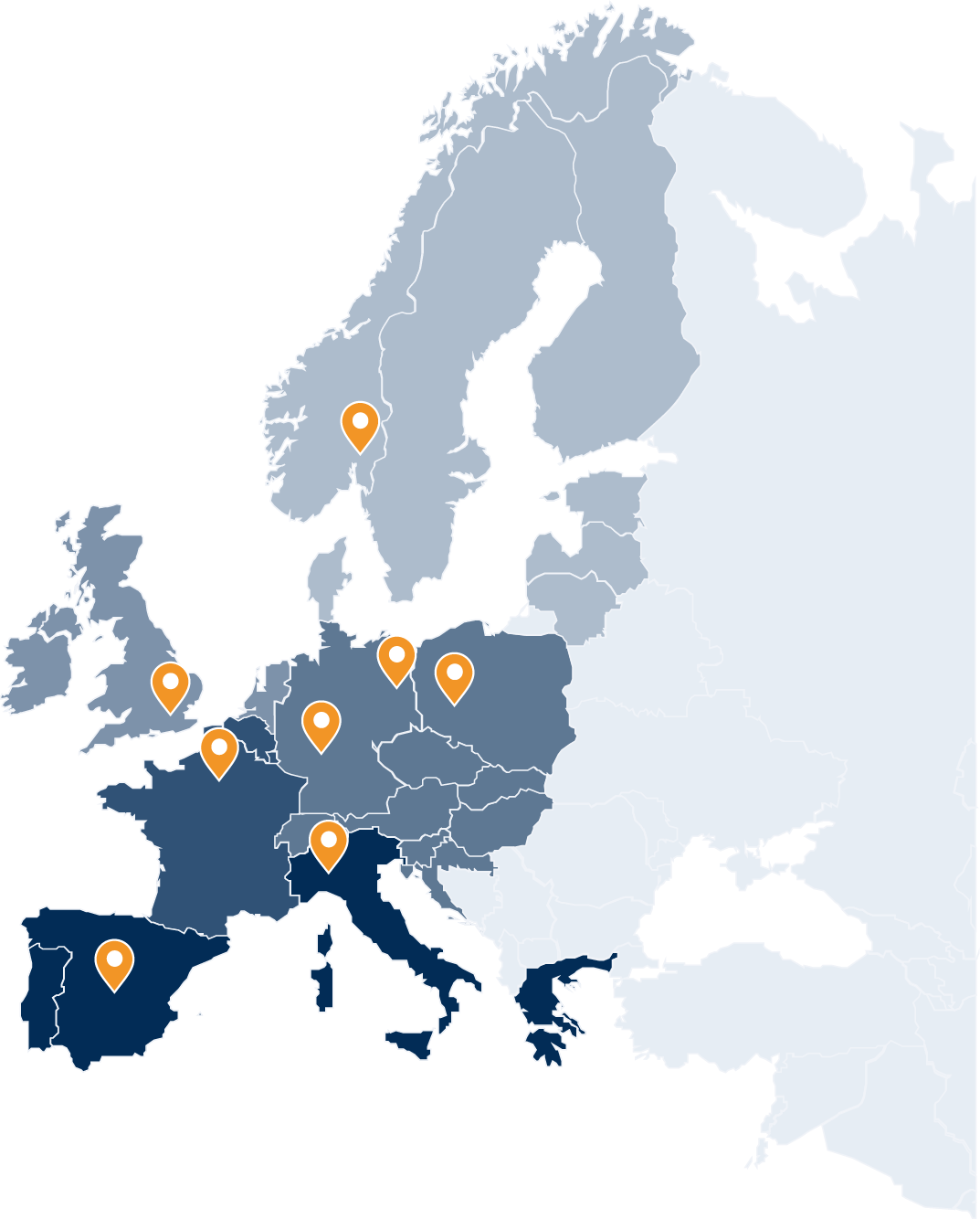

About Scope’s coverage of European banks: Scope rates more than 100 financial institutions with more than 4,500 individual outstanding bonds equivalent to an aggregate volume of EUR 2trn. Scope applies a distinctive approach to assessing credit risk in financial institutions, with methodologies tailored to European complexities. Our transparent, forward-looking methodology focuses on banks’ business models, while also accounting for resolution and recovery regimes, supporting rating stability and predictability over time.

More News on Scope Group:

.png)