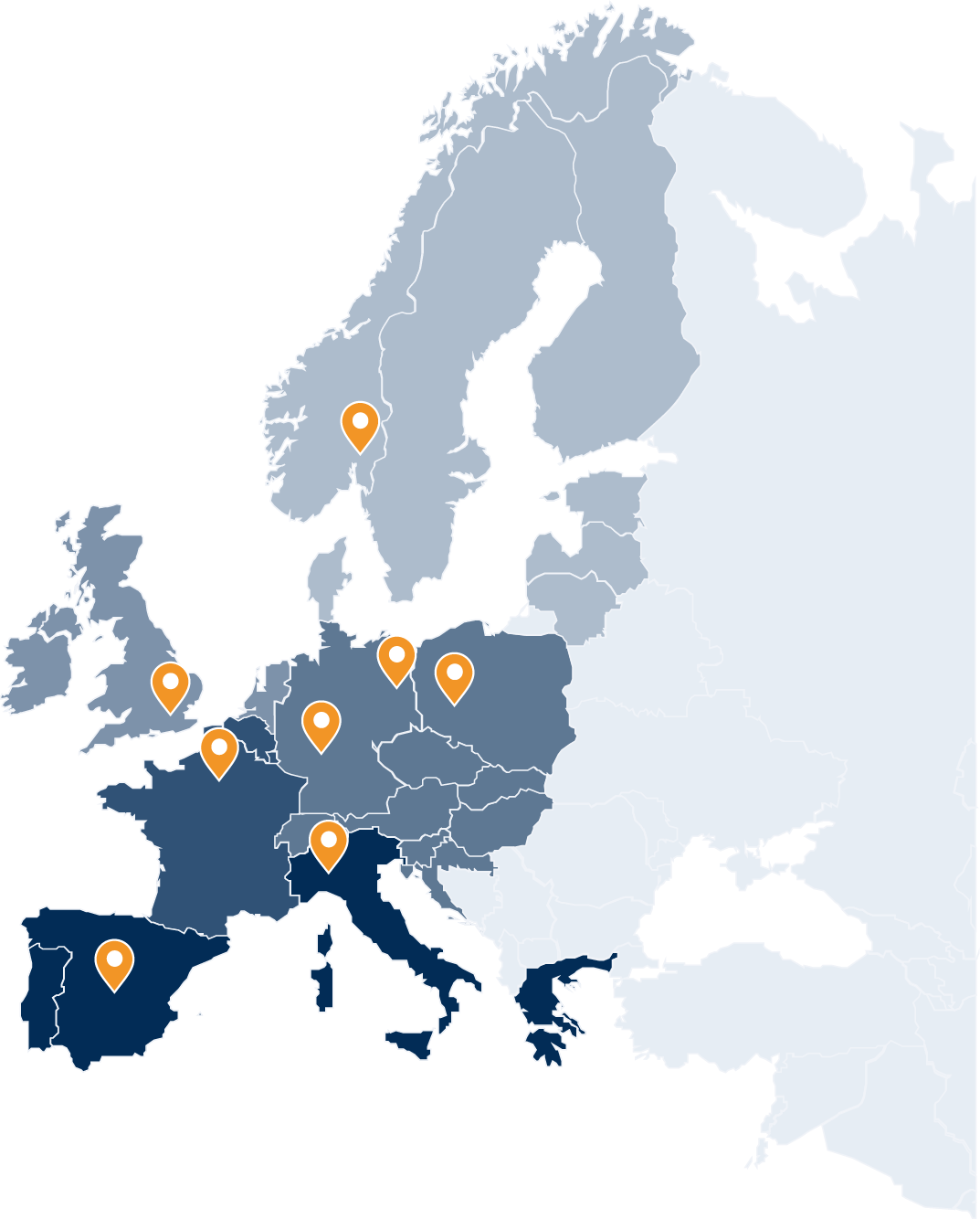

Our presence in Europe

Head of Sales Mr Vincent Georgel-O’Reilly +49 69 667738-970 v.georgel-oreilly@scopegroup.com

Central and Eastern Europe Mr Florian Stapf 49 69 6677389-25 f.stapf@scopegroup.com

France, Belgium and Luxembourg Mr Marc Lefèvre +33 66 28 93 512 m.lefevre@scopegroup.com

UK, Ireland and Netherlands Mr Keith Gilmour +442039368151 k.gilmour@scopegroup.com

Southern Europe Mr Carlos Romera Cano +34 91 572 67 11 c.romera@scopegroup.com

Nordics and Baltics Mr Petter Sødal Kristiansen +47 46 54 86 30 p.kristiansen@scopegroup.com

Sweden and CIS Mr Nicolas Cambier +46 723999 654 n.cambier@scopegroup.com

.png)