Our story

At Scope Group, we offer ratings and research to issuers and investors across all segments of debt capital markets. Scope Ratings is the leading European credit rating agency (CRA). Scope Fund Analysis is one of Europe’s leading providers of investment-fund ratings. Scope ESG Analysis assesses sustainability risks.

Our history goes back more than 20 years to 2002 when Florian Schoeller founded Scope in Berlin as a firm specialising in the analysis of alternative investments. Ten years later, we expanded into credit ratings with the goal of establishing the European alternative to the US rating agencies. Acquisitions followed. Scope acquired FERI EuroRating Services AG in 2016 and Euler Hermes Rating in 2021. Today, Scope Ratings is the uncontested market leader among European rating agencies.

Our progress has been backed by individual and institutional investors, among them AXA, Crédit Agricole, Groupe BPCE, DekaBank, RAG-Stiftung and HDI/Talanx. Our shareholder structure and the Scope Foundation guarantee Scope’s independence as a European rating agency. Today, we have around 750 issuer ratings and more than 13,500 bond ratings, equivalent to more than EUR 43trn in total debt rated.

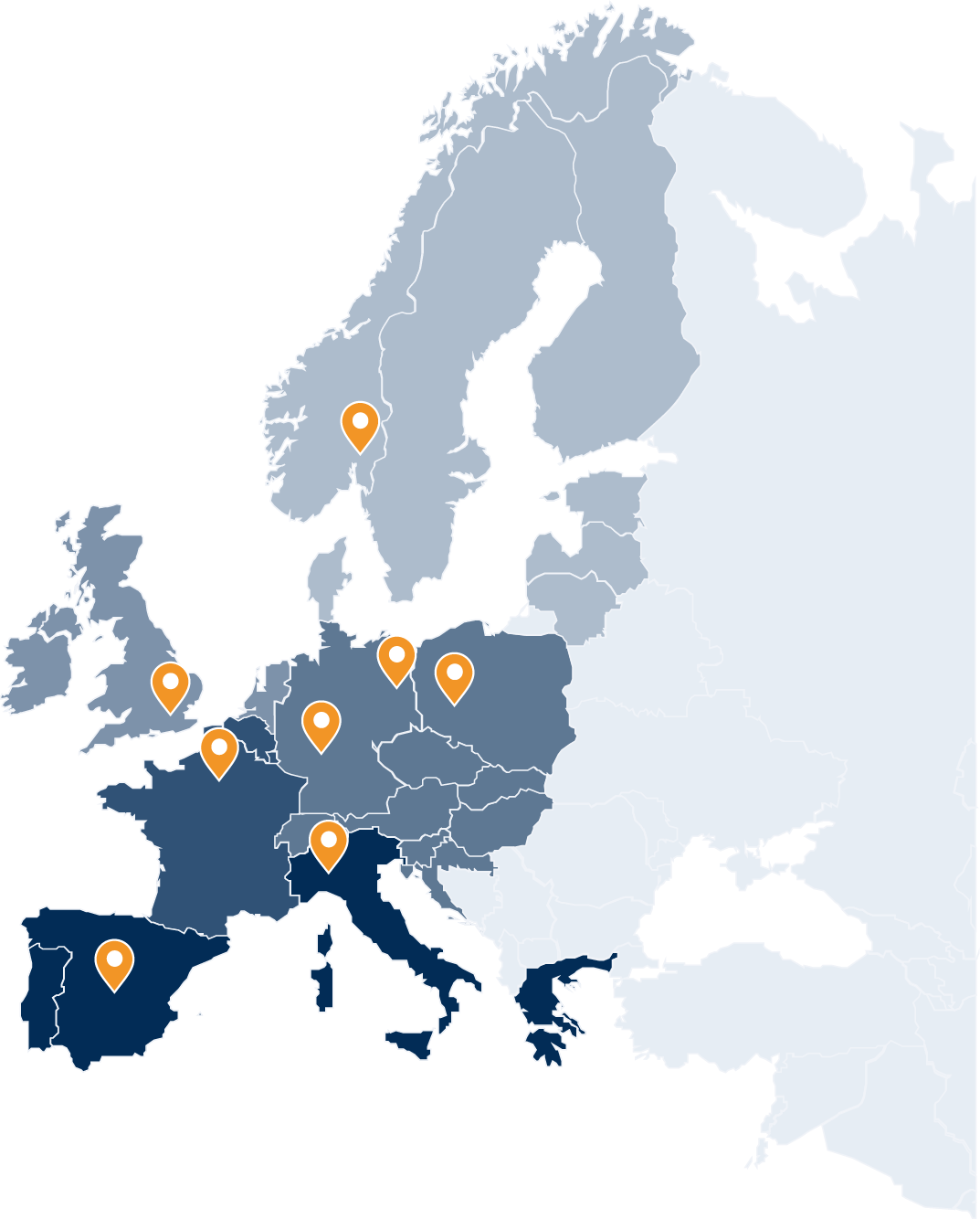

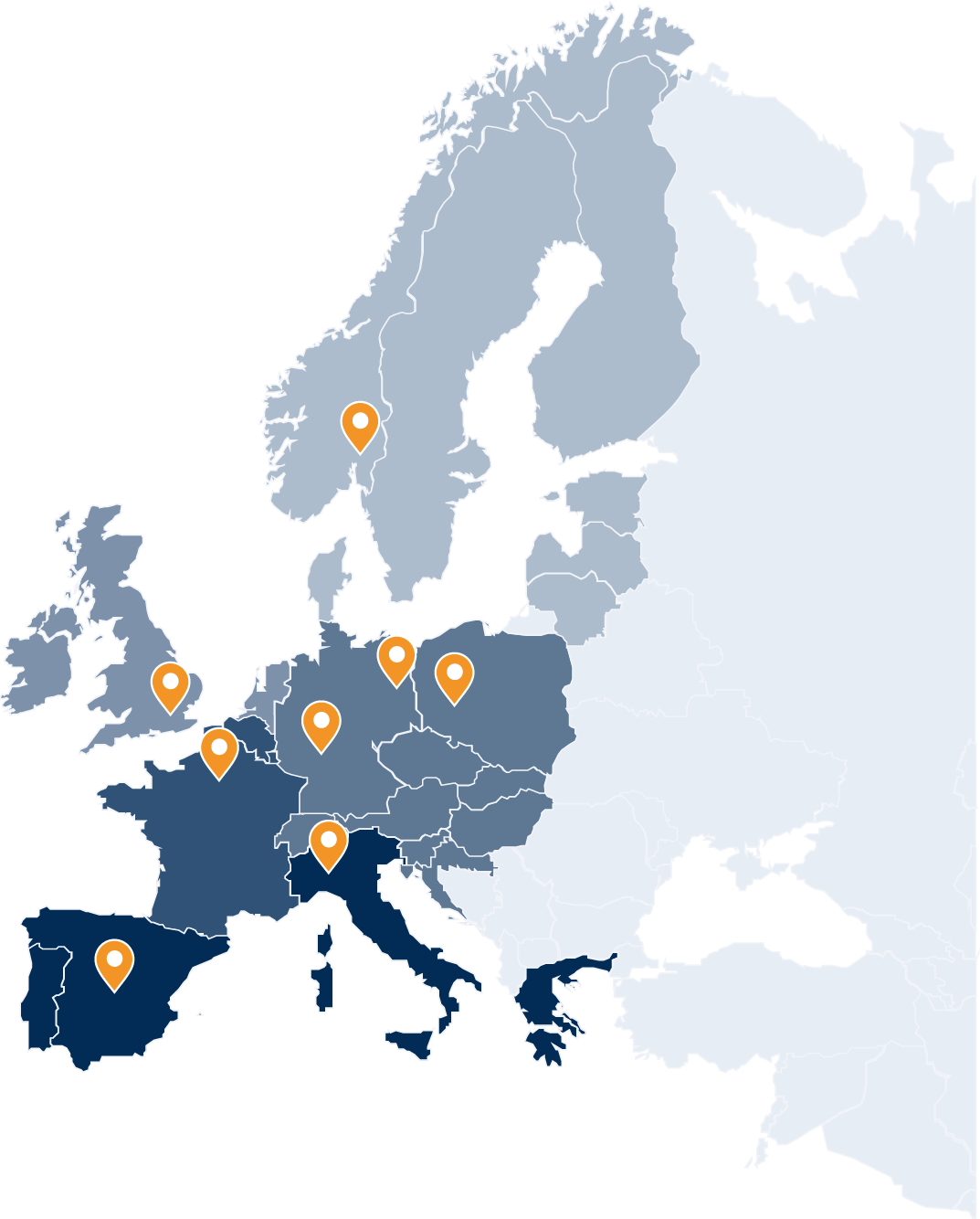

Scope’s analysts – based in Berlin, Frankfurt, London, Milan, Madrid, Oslo, Paris and Poznan – have developed progressive methodologies which recognise that understanding and capturing local political, economic, legal, social and cultural factors are crucial for accurately assessing credit, investment and sustainability risk.

Europe’s financial sovereignty: The ECB accepted Scope Ratings as a new external credit assessment institution in November 2023, making our credit ratings eligible for use in ECB monetary policy operations under the Eurosystem Credit Assessment Framework (ECAF).

Scope Ratings’ role in Europe’s financial system has also grown in importance, given recent geopolitical and macroeconomic developments. European policymakers have put Europe’s strategic autonomy at the top of their agenda, including completion of Europe’s capital markets union.

In this context, recognition of the value of our credit ratings has grown significantly, underlined by our ECAF status. We have secured mandates from Europe’s most important institutions: the European Union, the European Stability Mechanism and most recently the European Investment Bank.