Vasilis G. Kosmas, Chief Financial Officer of Alpha Bank, said: “By mandating the leading European rating agency, we are underlining our commitment to the highest standards of transparency and governance. The choice also reflects our confidence in the objective assessment of a credit rating agency that has a particularly good understanding of the regional market context. We are convinced that this decision will not only strengthen our position in European capital markets but will also enhance Europe’s financial-market autonomy.” Read the Alpha Bank press release.

Vincent Georgel-O’Reilly, Chief Market Officer Credit Rating of Scope Group, said: “We are delighted that Alpha Bank is the first systemically important Greek bank to have chosen Scope Ratings to provide an independent view of its credit risk. The rating mandate represents another milestone for our Financial Institutions franchise and increases the visibility of our public rating coverage. It also shows that Scope is increasingly an integral part of the European financial system.”

Scope rates Alpha Bank at BBB/Stable. The rating is anchored by the consistent business model centred around commercial banking in Greece, and benefits from improving asset quality and solid capital metrics. Read the full rating action release from 15 May 2025.

The latest Greek sovereign rating update was on 6 Dec 2024: Scope upgrades Greece's ratings to BBB and revises the Outlooks to Stable

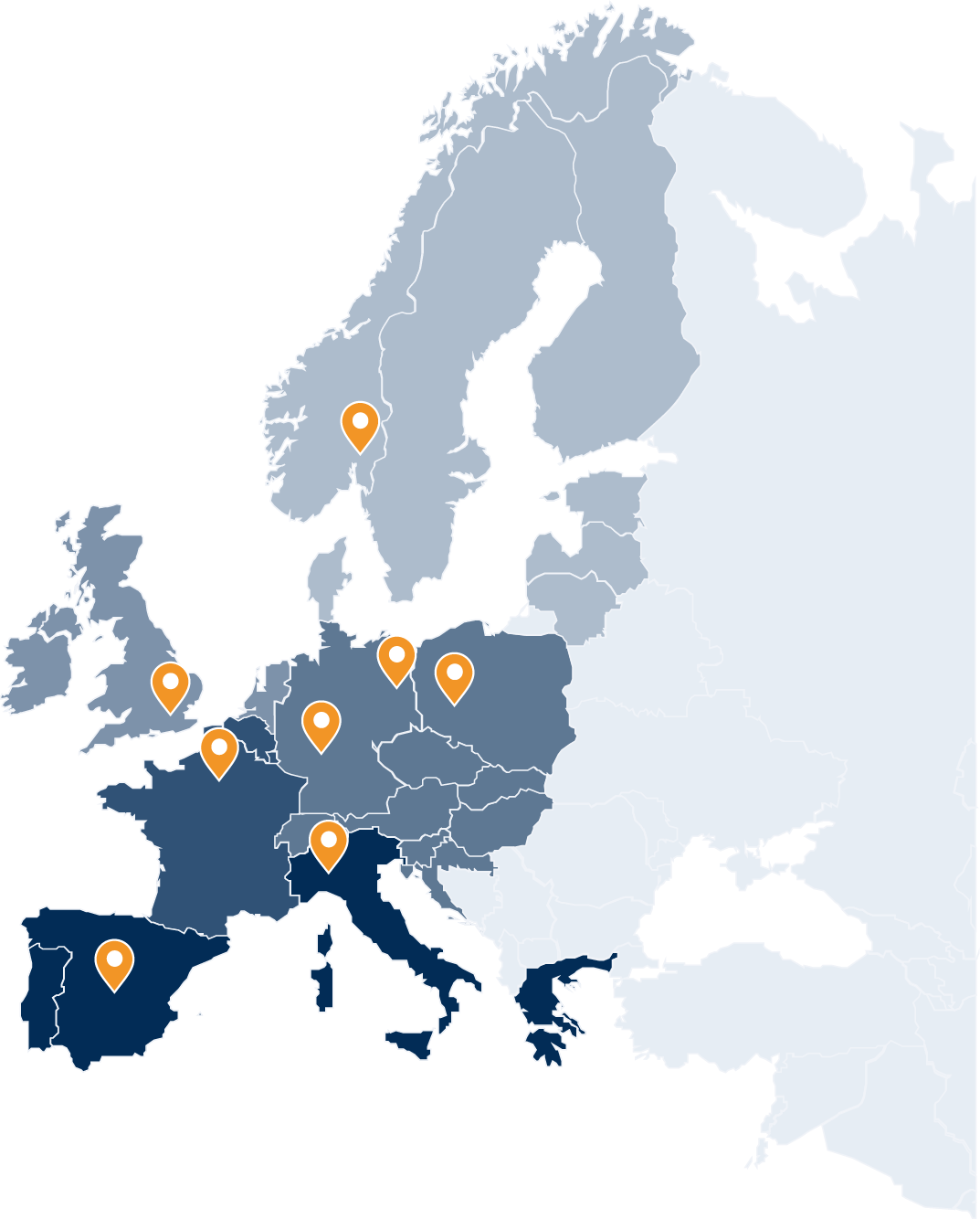

Scope’s coverage of European banks has grown steadily

Scope has steadily built up rating coverage of Europe’s leading banks over the years. Today, the agency rates more than 100 financial institutions with more than 4,500 individual outstanding bonds equivalent to an aggregate volume of EUR 2trn. Late last year, Scope started to publish selected ratings of Europe’s biggest banks – the two largest lenders in Germany, France, Italy and Spain – due to increased interest from market participants in systemically relevant institutions. More Info.

ECAF acceptance leads to issuer, investor demand for Scope’s ratings

Growing investor and issuer demand for Scope’s ratings follows the rating agency’s acceptance by the European Central Bank in its credit assessment framework (ECAF). Scope’s ECAF acceptance offers the ECB and other market participants a wider set of credit opinions while broadening the pool of eligible collateral for the central bank’s monetary policy operations. More on the implications of Scope’s acceptance, read the ECB Blog (Feb 2024).

About Alpha Bank: The Alpha Bank Group is a leader in the Greek banking sector, where it is present since 1879. Its purpose is to enable progress in life and business for a better tomorrow. Alpha Bank aims to deliver superior value for all stakeholders in a responsible manner, though a focused strategy built around its relationship excellence and leadership in high value segments, enabled by people and digital, alongside a clear identity grounded on trust, value creation and service excellence. Alpha Bank operates in Greece – serving approximately 3.5 million customers through a network of close to 270 branches – Cyprus, Luxembourg and the UK, with around 6 thousand employees and a wide range of financial products across Retail Banking, Wholesale Banking and Wealth Management.

More news on Scope Group: