Hon. Clyde Caruana, Finance Minister of Malta, says: “This mandate will provide Malta with a broader view of its credit risk, while enhancing its European rating perspective.”

Alvise Lennkh-Yunus, Head of Sovereign and Public Sector at Scope Ratings, says: “The mandate from Malta shows again that issuers and investors value a European perspective on credit risk.”

Scope rates Malta currently at A+ with Stable Outlook. The country’s strong growth prospects, consistent record of fiscal discipline, and solid external position underpin the rating. See the full analysis and rating rationale in the latest rating action release and full rating report (August 2024).

The ECB accepted Scope Ratings as a new external credit assessment institution in November 2023, making Scope’s credit ratings eligible under the Eurosystem Credit Assessment Framework (ECAF).

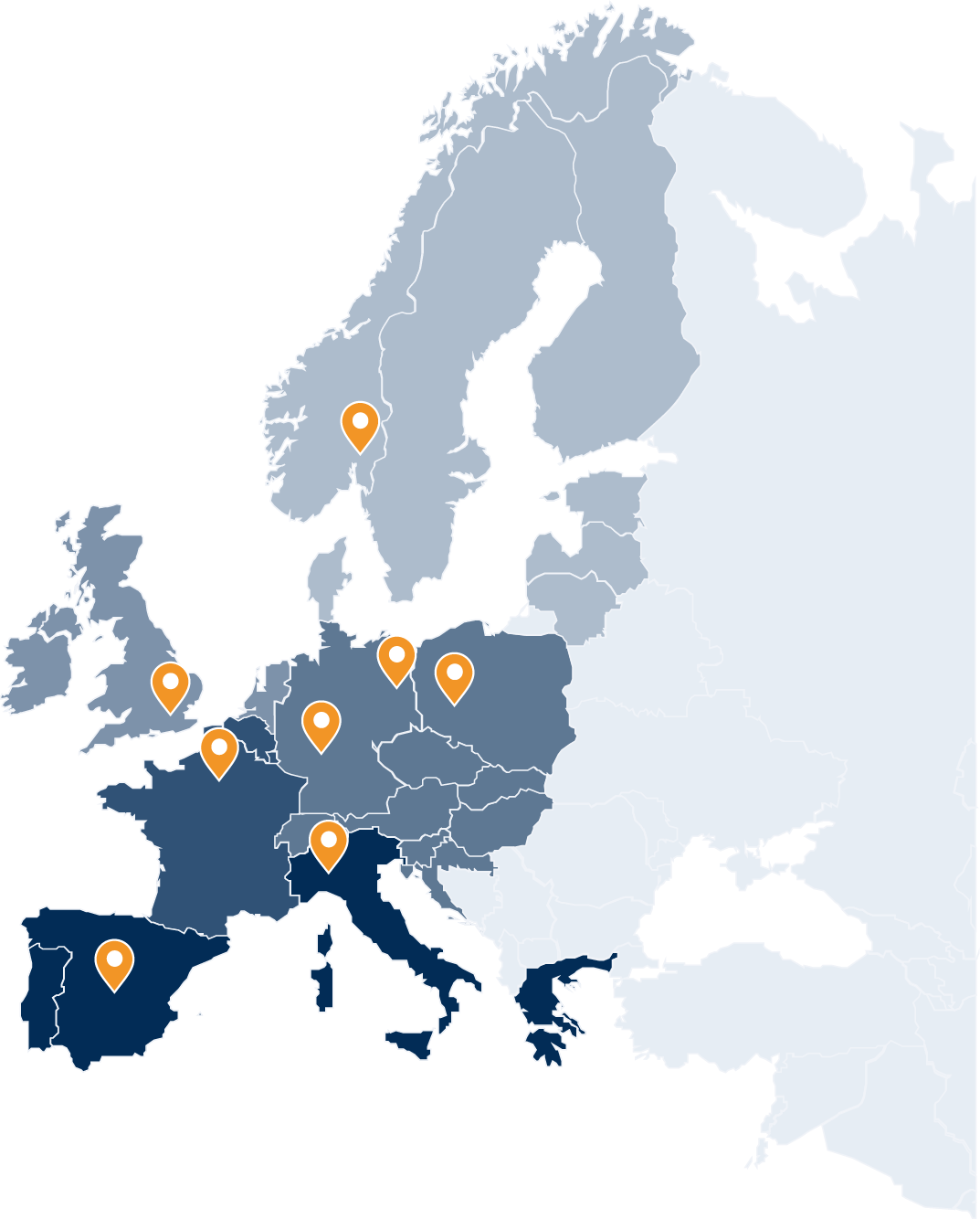

About Scope’s ratings: Scope offers a distinct European perspective on credit risk and provides credit analyses rooted in the European context by taking into account relevant local financial, political, regulatory, and legal factors into its analysis. Scope’s ratings therefore offer investors greater diversity of opinion while fostering competition in the credit rating industry. Scope’s ratings have historically exhibited less ratings volatility in crisis and stressed economic environments. Scope rates 100% of EU sovereign issuers and 75% of global sovereign debt since 2018. According to ESMA’s 2023 CRA Market Share Report, Scope has the second largest ratings coverage for public-sector issuers in Europe. For more details, please see Scope’s Sovereign rating coverage.

More news on Scope Group: