.png)

Scope Ratings published its first public rating on CADES on 28 June 2024 at AA with a Negative Outlook. CADES’s strategic importance to the French state, with which it is financially interdependent, and the high probability of extraordinary state support underpin the alignment with the French Republic's long-term ratings. Read the full rating action release in English. Read the full rating action release in French.

“We are delighted that CADES has chosen Scope Ratings to provide an independent view on their credit risk, joining the long list of European government-related entities rated by Scope. This mandate reflects the relevance of Scope for both investors and issuers, underscoring our distinctive analytical approach as the European rating agency,” said Guillaume Jolivet, Chief Analytical Officer of Scope Group and Managing Director of Scope Ratings.

“Our CADES mandate is another milestone for Scope in France because CADES is an important institution in France’s financial ecosystem and one of the biggest debt issuers in Europe,” said Marc Lefèvre, Head of Western Europe at Scope Group.

On CADES: The institution was established by the French government in 1996 to reduce the debt of France’s social security system. CADES is an autonomous central government entity, overseen jointly by the ministers of finance and social-security. CADES has planned a EUR 20bn medium- and long-term financing programme for 2024 and had EUR 145bn in social security debt at end-2023 to redeem by 2033. More info on CADES. For CADES’s announcement of its choice of rating agencies, please follow this link.

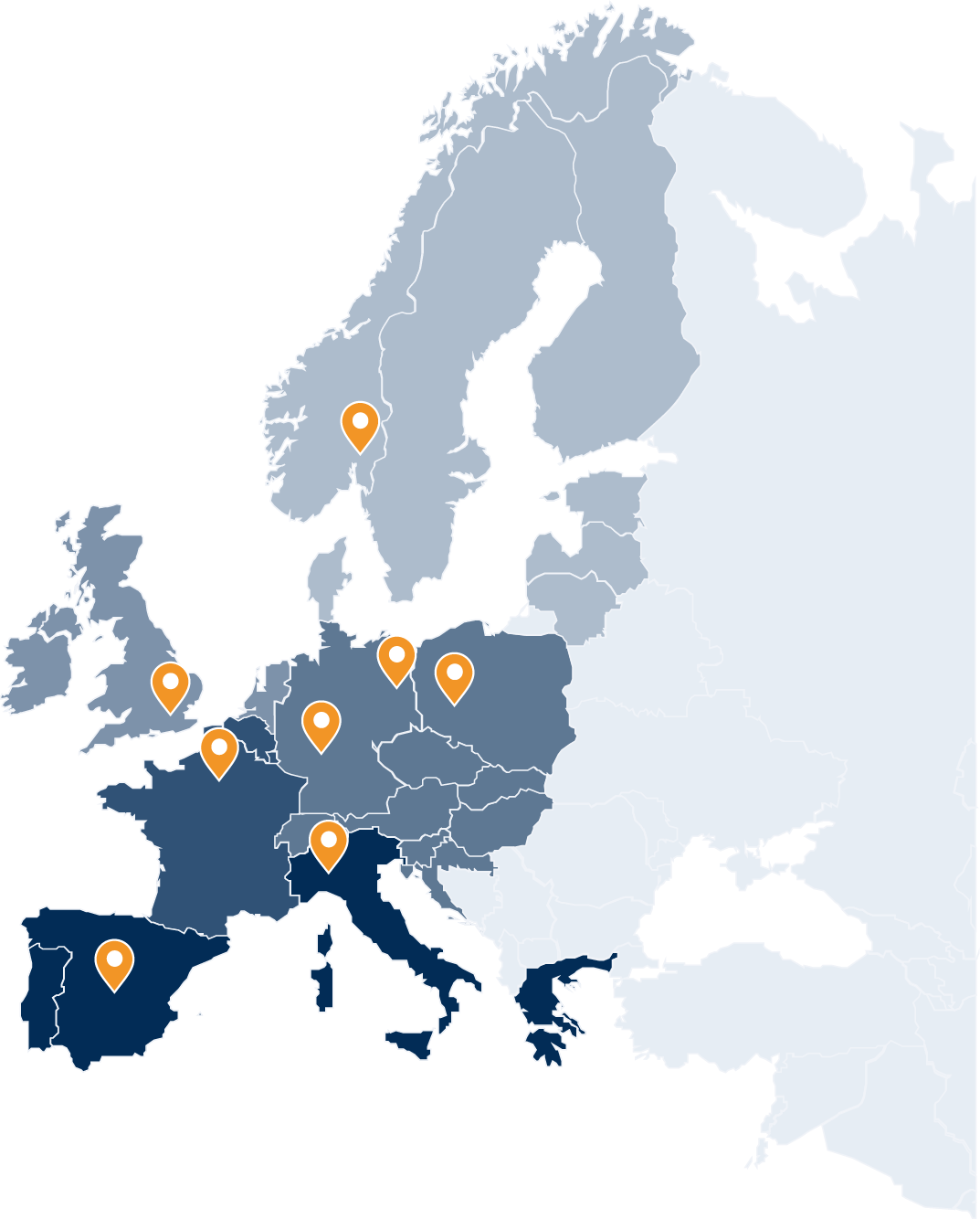

On Scope’s GRE rating coverage: Scope rates a broad range of GRE issuers representing an outstanding bond volume of more than EUR 600bn including mandated ratings on KfW, L-Bank and Uniper in Germany, Poste Italiane and Cassa Depositi et Prestiti in Italy, ORF and EVN in Austria, MFB Hungarian Development Bank in Hungary, Hafslund and Posten Norge in Norway, and Neova Oy in Finland.

On Scope’s GRE methodology: Scope uses a qualitative segmentation approach to account for the diverse entities, jurisdictions, and relationships between GREs and their public sponsors. Scope may apply the GRE criteria in conjunction with other sector-specific criteria, such as the Corporate Rating Methodology or Financial Institutions Criteria. It uses two approaches – “top-down” and “bottom-up” – to determine the primary rating driver, which could be either the entity’s public sponsor (top-down) or its standalone creditworthiness (bottom-up). To access Scope’s GRE methodology, please follow this link.

More news on Scope Group:

.png)