Enno Dykmann, Head of Treasury at Alliander, said: “As one of Europe’s highest rated utilities active on the region’s debt capital markets, this mandate reflects our confidence in Scope’s analytical expertise and robust methodologies. At the same time, it signals our commitment to fostering greater diversity of credit opinion in Europe and strengthening the autonomy of the region’s capital markets.”

Charles-Henri Aulagner, Director Sales of Scope Group, said: “This mandate represents not only a major milestone for our Corporate ratings franchise, strengthening the visibility and reach of our public rating coverage but it also marks another important step for Scope’s activities in the Netherlands, following the recent rating mandate from ING Group. We are delighted by the growing recognition that Scope has in the Netherlands’ sophisticated capital market.”

Scope rates both Alliander and its subsidiary Liander at A+ with Stable Outlook. The rating is supported by a very strong business risk profile and the company’s status as a government-related entity. Read the full rating action release from 19 December 2025.

About Alliander: Alliander is a leading energy network company in the Netherlands. With over 10,000 employees Alliander serves more than three million homes and businesses via more than 90,000 km of electricity and 40,000 km of gas grids. As a group, Alliander affiliates – including Liander – optimize energy distribution while preparing the grid for the future of sustainable energy. Alliander has a strong presence in the capital markets.

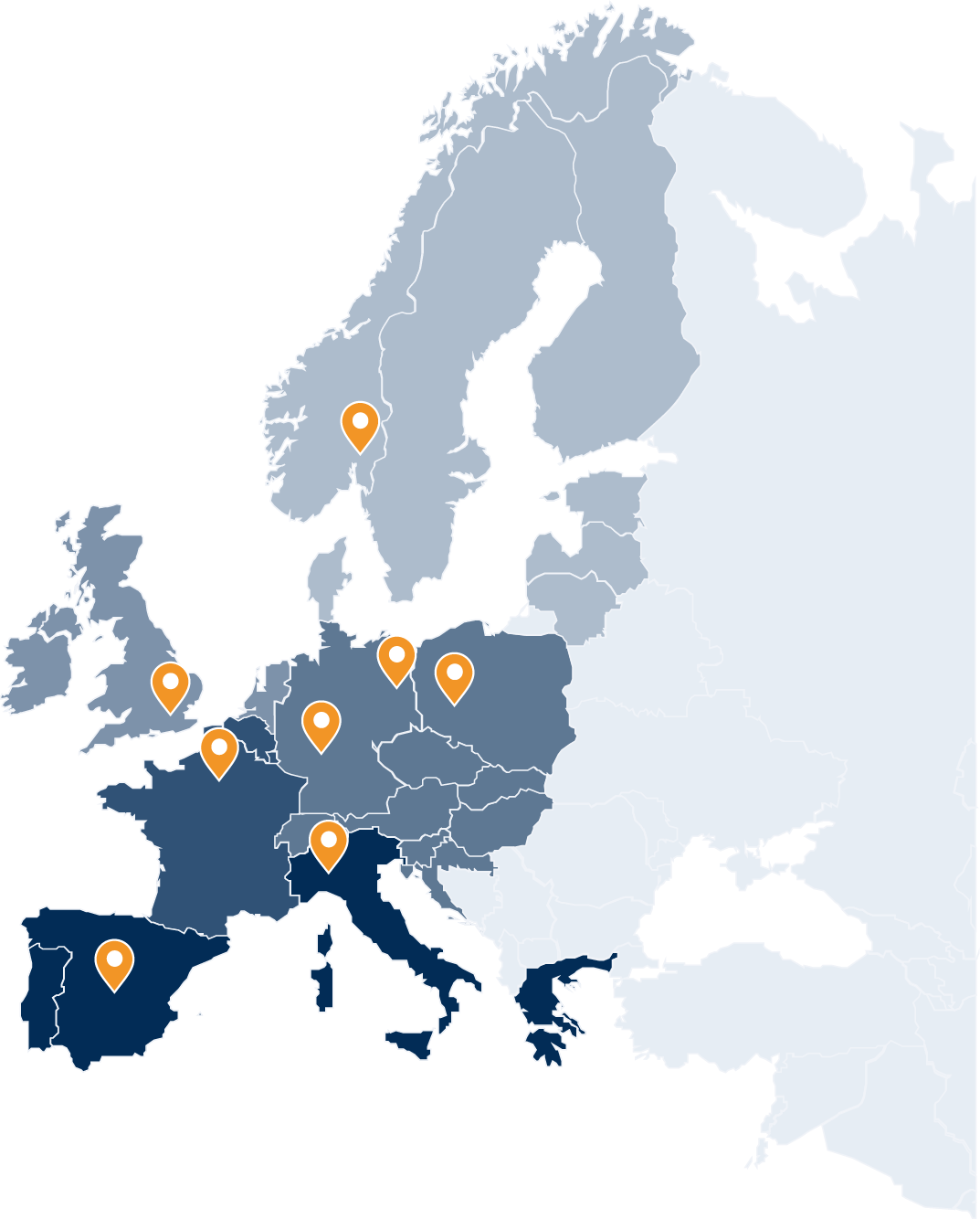

About Scope’s rating approach and coverage: Scope is the leading European credit rating agency (CRA) and the only European credit assessment institution accepted in the ECB’s credit-assessment framework. Scope’s distinctive approach provides opinion-driven and forward-looking credit analysis with a European perspective that recognises the local conditions – financial, political, regulatory, judicial and cultural – in which issuers operate. As a full-service, multi-sector CRA, Scope rates more than 13,500 bonds from over 750 issuers. The amount of rated debt is worth more than EUR 43trn. In Europe, Scope has the second largest rating coverage of public-sector issuers and the third largest for non-financial corporates.

More news on Scope Group: