Darko Vuković, CFO from Elixir Group, said: “The rating from Scope is a very important milestone in our corporate development as it marks our capital-market debut. We are delighted that with a rating from Scope we can present our investors with a professional and capital-market-accepted perspective on our company's credit quality. We are impressed by the rigour and efficiency with which the rating process was carried out.”

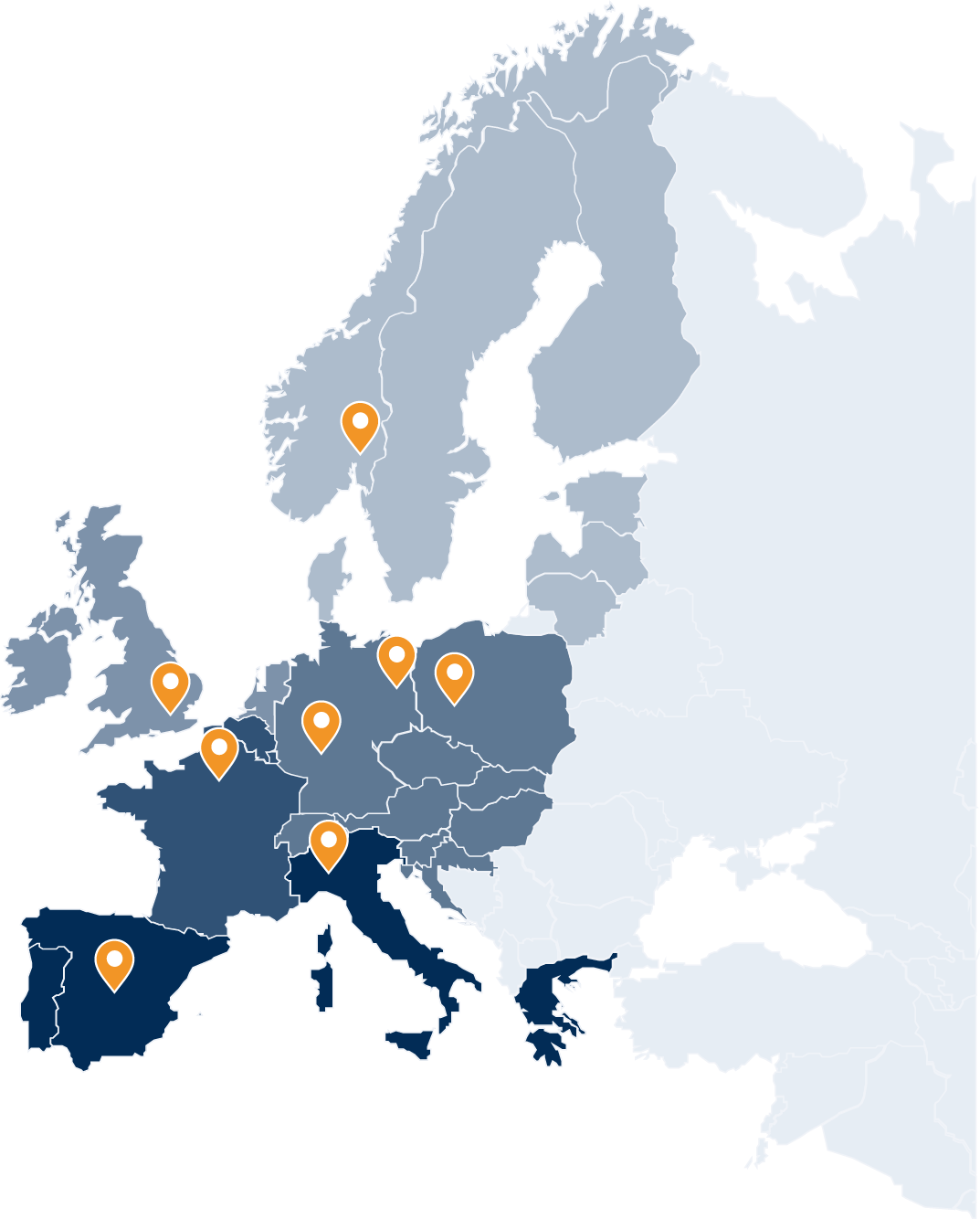

Florian Stapf, Head of Business Development Fundamental Ratings at Scope Ratings, said: “We are delighted that Elixir Group is the first major Serbian company to select Scope for a rating mandate as part of the government-World Bank programme to enhance Serbian companies’ access to capital markets. We are confident that other Serbian companies will follow suit later this year. The rating mandate also strengthens Scope’s focus on the CEE/CIS regions where we have more than 100 rating mandates delivered for companies across multiple sectors from Hungary to Georgia.”

Scope rates Elixir Group at BB/Stable. The rating is driven by Elixir's robust position in the production of fertilisers and phosphoric acid, and Scope's expectations for gradual improvements in the company's margin profile and credit metrics during the current investment phase. Read the full rating report.

For more details about Scope’s ratings and views on European companies, read Scope’s recently published Corporate Outlook 2025.

On Elixir Group: Elixir Group is the leading producer of phosphoric acid in region and the largest producer of complex mineral fertilizers in southeastern Europe. Elixir, founded in 1990, exports at least 70% of its production to 85 countries. More information.

On Scope’s corporate rating coverage: Scope currently rates around 280 European companies and around 3,500 corporate bonds. According to the recent ESMA market share report (page 10) Scope’s rating coverage of European companies is the third largest of all rating agencies. Scope’s total rating coverage includes solicited and unsolicited ratings.

On Scope’s corporate rating methodology: With ratings and research rooted in a European perspective on corporate performance which pays close attention to regional differences, Scope provides a diversity of credit opinion that enhances the ability of issuers and investors to manage risk and improve returns. Scope’s modular, flexible and opinion-driven methodologies strike an appropriate balance between analytical consistency and issuer-specific characteristics, notably regarding corporate structures, pensions, cash management, ownership and owners’ business philosophy. See all of Scope’s corporate rating methodologies here.

More news on Scope Group