.png)

Norges Bank, the Norwegian central bank, now accepts credit ratings from Scope Ratings in its guidelines for pledging collateral for loans. Please see full statement of Norges Bank from 3 Nov 2022 here.

Norges Bank had previously accepted credit ratings only from Standard & Poor’s, Fitch and Moody’s. Scope Ratings is the first European rating agency accepted by the central bank.

The move by Norges Bank will help Scope’s clients in Norway as bonds rated by Scope can now be used as collateral for the central bank’s loan programs. “The decision is a milestone for Scope, showing how we are increasingly integral to the financial ecosystem in Norway,” said Petter Kristiansen, Scope’s head for the Nordic & Baltic region.

Norges Bank explained the decision as follows: “The choice of Scope is based on an assessment of coverage, price structure for data delivery and other contractual terms and conditions among a selection of credit rating agencies subject to the Credit Rating Agency (CRA) Regulation.” Norges Bank also said that increasing competition among rating agencies is an important factor in its decision. See full consultation paper from earlier 2022: Changes to the guidelines for collateral for loans from Norges Bank

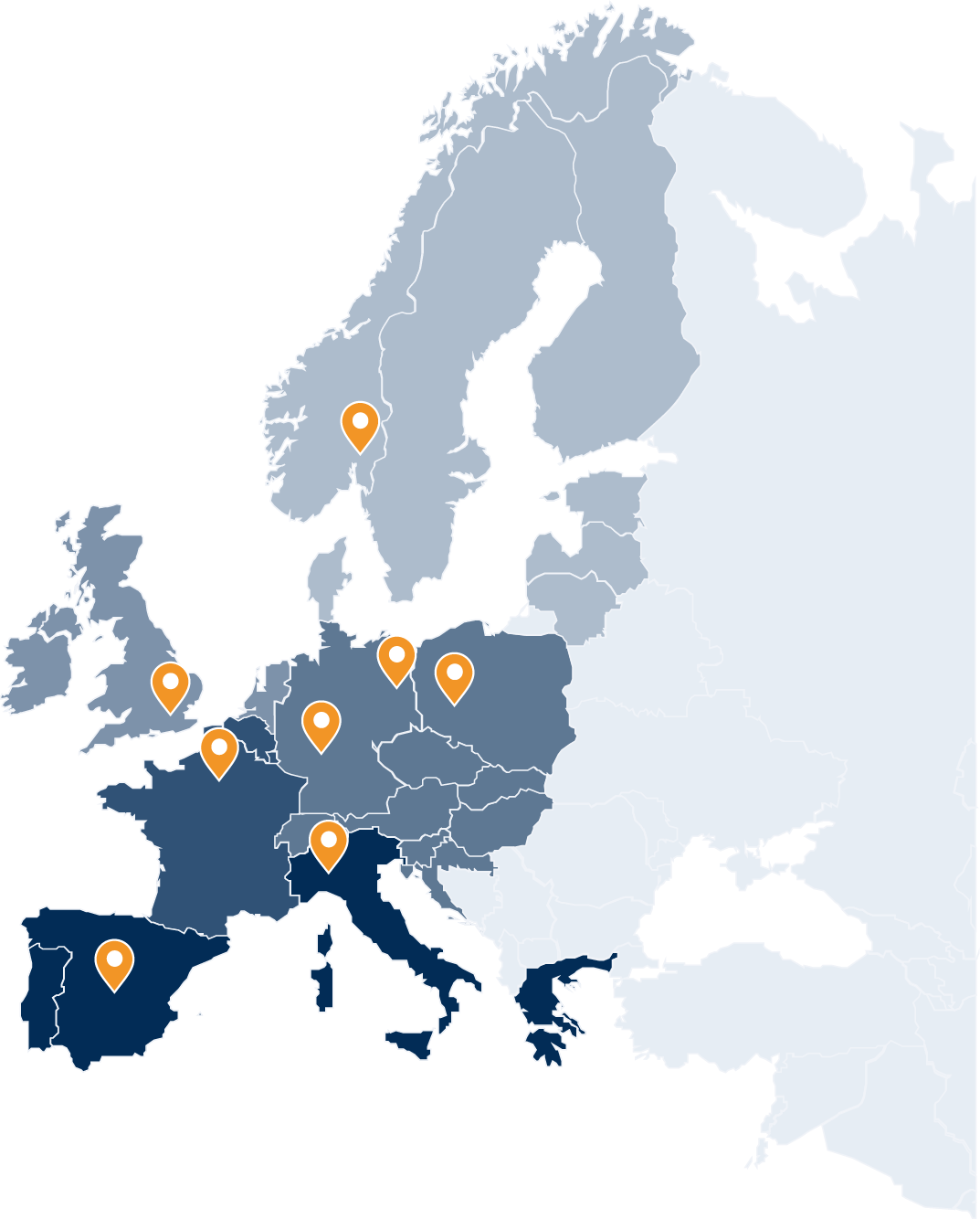

Background – Scope in Norway: Scope Group has operated in Norway since 2017 from its office in Oslo, the base for its team of analysts. The Oslo office serves as the Nordic hub for Scope’s operations in the wider Nordic & Baltic region. In Norway, Scope has more than 70 clients – issuers and investors – with its rating services on financial institutions, corporates, covered bonds, structured and project finance as well as sovereign & public sector institutions.

Further recent news from Scope Group:

.png)