Gabriela Pantring, Deputy Chairwoman of the Managing Board of NRW.BANK: “Mandating the leading European rating agency for the first time is more than a technical decision – it’s a strategic statement to the market and our stakeholders. As Europe strengthens its capital markets, we believe strategic autonomy starts with trust and transparency. By partnering with a German-based, highly ambitious agency, we support the vision for resilient, competitive financial ecosystems.”

Florian Schoeller, CEO and founder of Scope Group: “Development banks are a driver of economic development in Europe and important players in capital markets. We are delighted that NRW.BANK has chosen Scope Ratings to provide an independent view of the bank’s credit risk. NRW.BANK joins a growing list of European development banks rated by Scope at a time of geopolitical upheaval when it is crucial for Europe to enhance its strategic autonomy. A diversity of credit opinion not only makes our debt capital markets more efficient but also reduces their reliance on the US, a key objective for Scope from our very early days.”

Scope rates NRW.BANK at AAA with Stable Outlook. The rating is equalised with the Federal State of North Rhine-Westphalia’s due to the explicit refinancing guarantee the state provides to NRW.BANK. Further, NRW.BANK benefits from a mature legal setup, high strategic importance and strong fundamentals. Read the full rating action release from 19 January 2026.

Scope was already mandated by North Rhine-Westphalia, the owner of NRW.BANK, in 2024.

About NRW.BANK: NRW.BANK is the promotional bank of North Rhine-Westphalia (NRW). In close partnership with its owner, the State of North Rhine-Westphalia, the Bank helps to strengthen SMEs and start-ups, create affordable housing and improve public infrastructure. NRW.BANK offers people, enterprises and local authorities in NRW tailor-made financing solutions and advisory services. It cooperates with its financing partners, in particular all banks and savings banks, on a competition-neutral basis. In order to accelerate the transformation processes, the Bank provides effective promotional impulses – for a sustainable, climate-neutral and digital North Rhine-Westphalia.

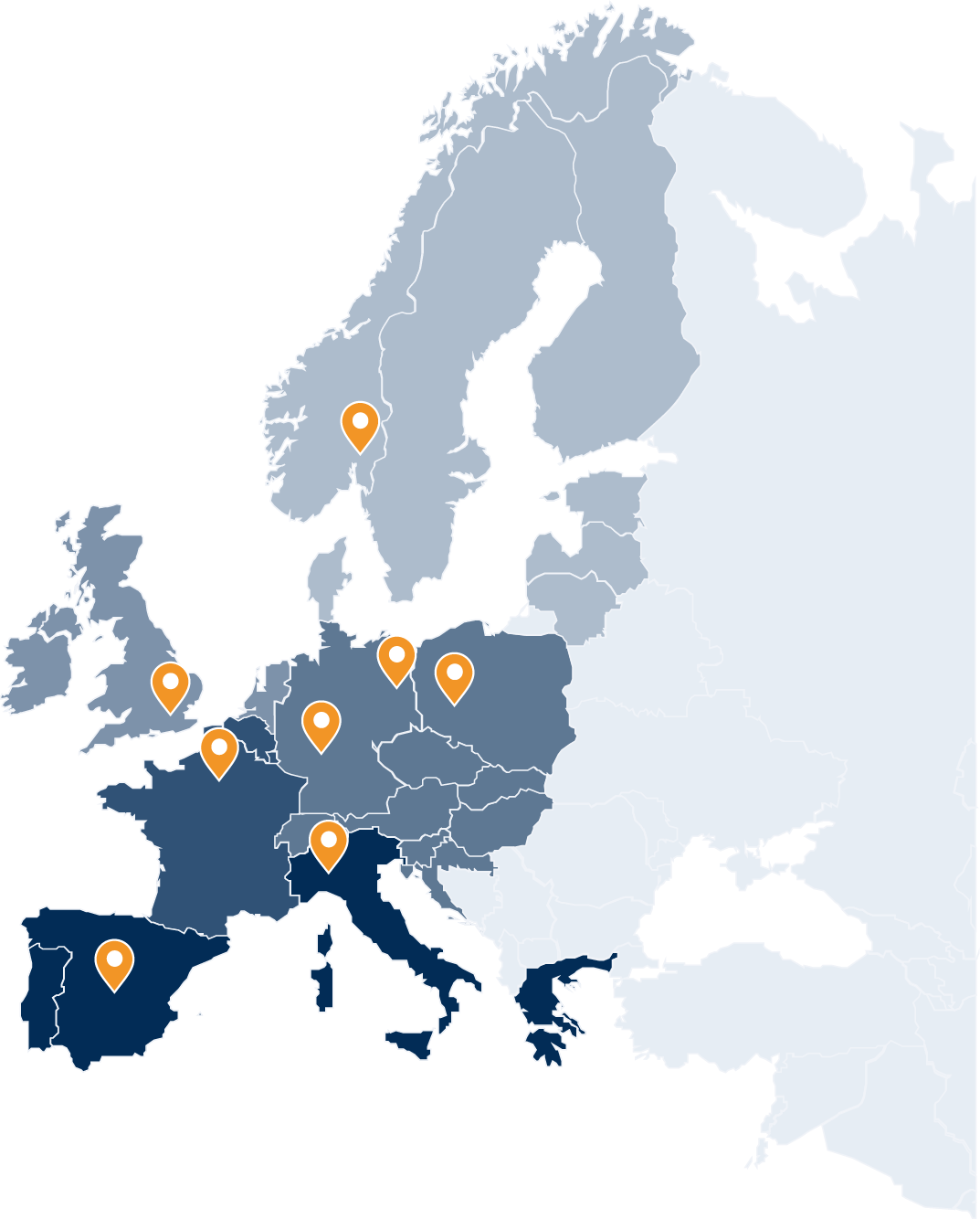

On Scope’s government-related entities (GRE) rating coverage: Scope rates more than 100 government-related entities (GREs) with an outstanding bond volume exceeding EUR 600bn, including mandates from Cassa Depositi et Prestiti, CADES, ICO, KfW, L-Bank, LfA Förderbank Bayern, MFB Hungarian Development Bank and Rentenbank. Scope uses a qualitative segmentation approach to account for the diverse entities, jurisdictions, and relationships between GREs and their public sponsors. For Scope’s GRE methodology, please follow this link.

More News on Scope Group: