The Scope Group, Europe’s leading provider of independent ratings, research and risk analysis for all asset classes, has been able to gain relevant institutional investors as shareholders as part of capital increases with a volume of over 35 million euros across several tranches. With HDI, the parent company of Talanx, Signal Iduna and SV SparkassenVersicherung, the Scope Group’s shareholders now include three prominent German insurance companies. Institutional investors from Austria, such as Vienna-based B&C Beteiligungsmanagement, are also shareholders. With Die Mobiliar from Switzerland and Foyer from Luxembourg, insurance companies from other neighbouring countries are likewise investing in Scope.

“We see ourselves as the rating agency for institutional investors,” says Florian Schoeller, CEO and founder of the Scope Group. He believes that insurance companies in particular see Scope as a reliable partner due to their long-term investment orientation. This boosts Scope’s development as an internationally active full-service provider of ratings and risk analysis. According to Schoeller, “Institutional investors who buy into the company are primarily motivated by their interest in establishing a European rating alternative, in addition to expectations around Scope’s value development.”

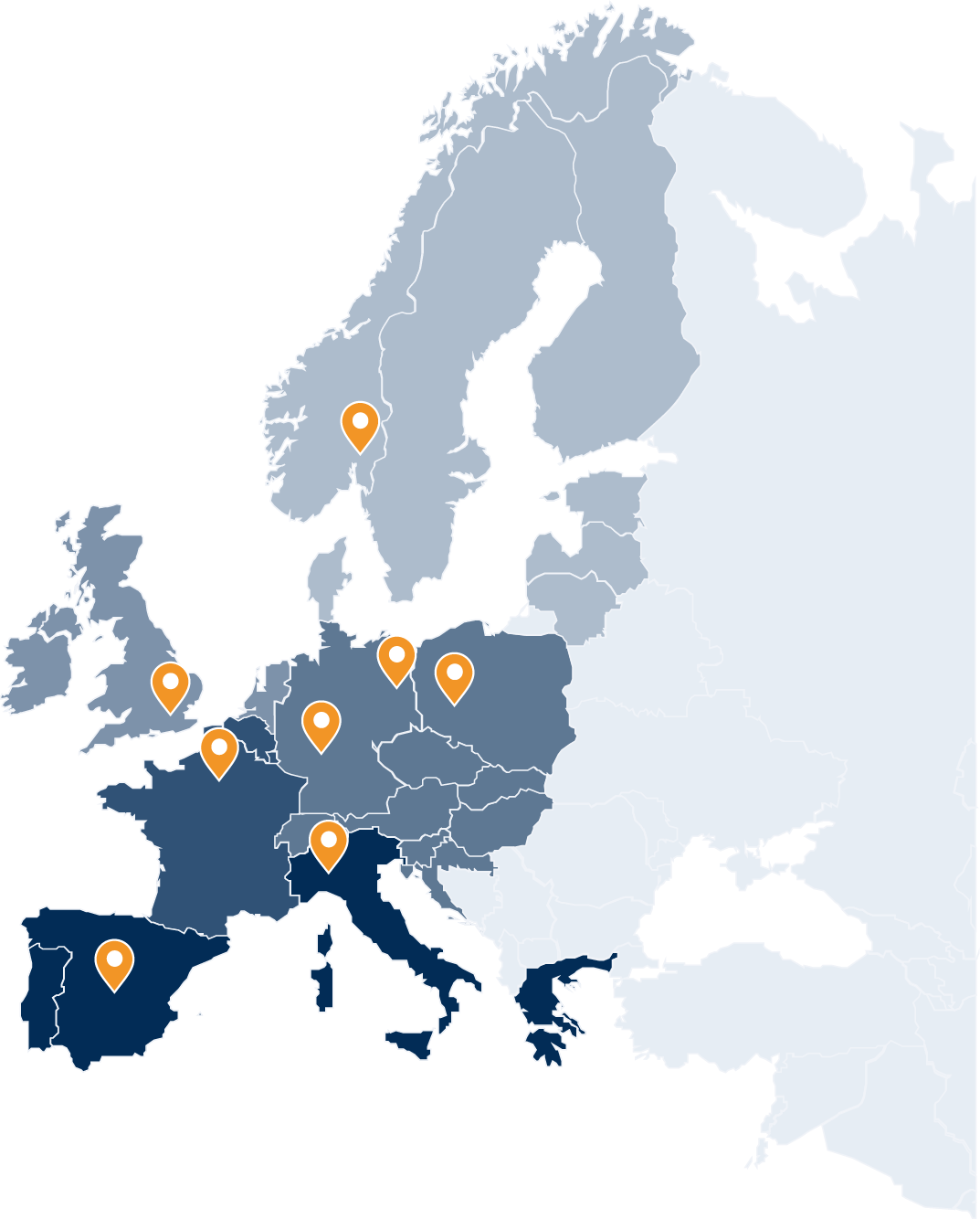

Scope is currently investing heavily in expanding its market coverage in major European growth markets, primarily France, Spain, Italy and Scandinavia. By 2021, the Corporates division aims to achieve market coverage comparable to that of the three major US rating agencies. In addition, the Scope Group has developed an innovative digital platform which will connect institutional investors in future and offer easier access to comprehensive risk analysis.

Since 2013, Scope has been pushing ahead with the establishment of a European rating agency as an alternative to the US agencies. Over 200 employees now work for the group at seven European locations. Scope has already been commissioned to rate numerous major European banks and industrial groups. These include Daimler, Sanofi, Lufthansa and other DAX and MDAX companies for the Corporates division, UBS, Commerzbank, Credit Foncier and Italy’s CDP for the Financial Institutions division and Barclays, Banco Santander and the European Investment Bank in Structured Finance. In order to maintain a clear separation between equity participation and credit rating, Scope will not assign any ratings to insurance companies for the time being.