With the ECB’s integration of Scope’s ratings in the Eurosystem Credit Assessment Framework (ECAF), Scope-rated debt instruments are now eligible as collateral in the central bank’s monetary policy operations. Scope is the only European rating agency whose ratings are used by the ECB and the national central banks of the euro area.

Guillaume Jolivet, Managing Director of Scope Ratings and Chief Analytical Officer of Scope Group, said: “The Eurosystem is now using the risk assessments of a European rating agency for the first time. Issuers and investors will benefit from a greater diversity of credit opinion to manage credit risk. Scope’s onboarding by the ECB is an important step in increasing Europe's financial sovereignty by reducing issuer and investor dependence on US-based rating agencies and supporting the European capital markets union.”

Vincent Wald, Managing Director of Scope Ratings and Head of Credit Rating Operations, said: “The technical integration of our ratings in ECAF underlines how relevant Scope has become in the euro area financial system. Scope is the only European rating agency competing on a level playing field in Europe with the rating oligopoly.”

Scope publishes ratings of eight European banking groups

Integration in ECAF, originally announced in November 2023, has led to accelerated investor and issuer demand for Scope’s ratings, particularly those of financial institutions.

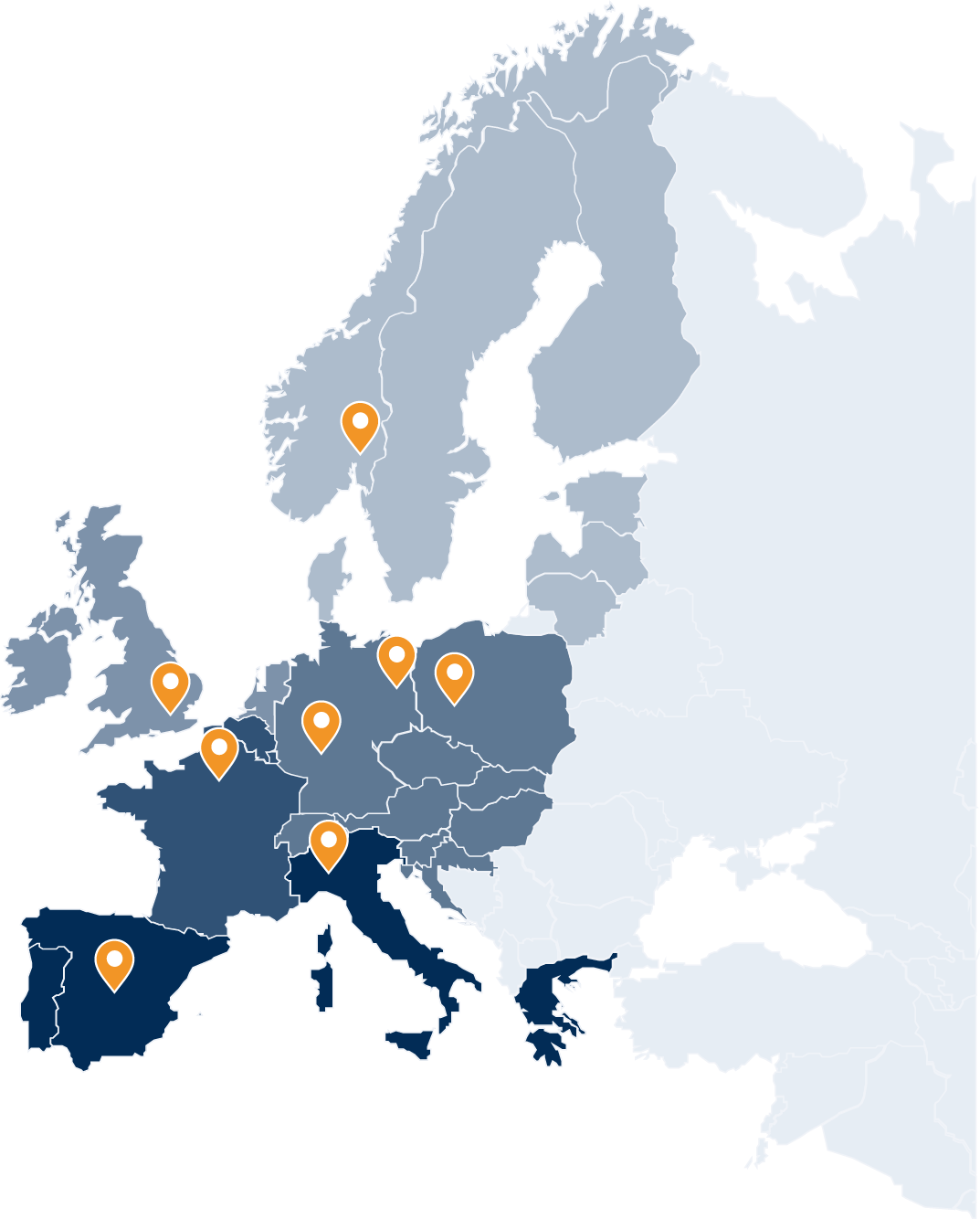

Scope has steadily built up rating coverage of Europe’s leading banks over the years. Today, the agency rates more than 100 financial institutions with more than 4,500 individual outstanding bonds equivalent to an aggregate volume of EUR 2trn. Until now, most of these ratings have only been available to investors on a subscription basis. Scope has now decided to publish selected ratings of Europe’s biggest banks – the two largest lenders in Germany, France, Italy and Spain – due to increased interest from market participants in systemically relevant institutions.

Marco Troiano, Head of Financial Institutions, said: “Our rating approach offers investors an additional perspective on banks’ credit risk based on a through-the-cycle view of bank business models, and emphasises the European banking union as a core credit strength. In our view, banks in the euro-area benefit from the EU’s strengthened institutional architecture.” (For more on Scope’s rating approach and differentiating factors please click here.)

Recent rating actions (published on 13 December 2024):

The public rating information on these eight banks includes issuer ratings and senior unsecured debt ratings. Individual bond ratings and rating reports will be available on ScopeOne, Scope’s investor platform.

Implications of Scope’s ECAF acceptance: The acceptance of Scope Ratings offers the ECB and market participants a wider set of credit opinions and it broadens the pool of eligible collateral as Scope rates assets and debt instruments not rated by the other agencies. Banks can therefore further diversify their collateral pools for central bank funding. More on the implications of Scope’s acceptance, read the ECB Blog (Feb 2024).

About ECAF: The primary goal of ECAF is to ensure the creditworthiness of counterparties and the collateral used in the Eurosystem's credit operations. ECAF aims to harmonise credit assessment standards across the euro area, ensuring consistency and fairness in how collateral is assessed. With ECAF accreditation, Scope’s credit ratings can be used to fulfil credit quality requirements of marketable assets that are eligible as collateral in Eurosystem monetary policy operations. More on ECAF.

More news on Scope Group: