DekaBank will use the ratings to calculate capital requirements and aims at appointing Scope as an External Credit Assessment Institution (ECAI). Deka will also integrate Scope’s ratings to support its risk and investment decisions. All relevant units of Deka will have access to ScopeOne, the digital platform hosting all of Scope’s credit rating and research. Deka has also made Scope's ratings available in Deka Easy Access (DEA), the web-based data, information and trading platform that enables more than 300 savings banks and Deka's institutional customers to manage and trade their own portfolios.

Thorben Lüthge, Head of Markets at DekaBank, said: “We utilise Scope’s analyses in order to further optimise our risk assessments and investment decisions. This not only strengthens our market position but also provides clear added value to our customers and partners.”

Vincent Georgel O’Reilly, Group Managing Director at Scope and Head of Sales said: “The value of our ratings and research is derived from its acceptance by investors and banks. After the recent recognition of our ratings by the ECB, we are delighted that Deka is now fully integrating our ratings. This is also good news for all issuers that have mandated Scope because Deka is one of the largest investors in Europe.”

About Deka: DekaBank is the securities services provider of the German Savings Banks Finance Group (Sparkassen-Finanzgruppe). Together with its subsidiaries it forms Deka Group. With total customer assets of more than EUR 402 billion (as at 30/06/2024) and 5.6 million securities accounts, DekaBank is one of the largest securities services providers and real estate asset managers in Germany. It provides private and institutional investors with access to a wide range of investment products and services. DekaBank is firmly anchored in the Sparkassen-Finanzgruppe (Savings Banks Finance Group) and tailors its product portfolio to the requirements of its owners and sales partners in the securities business.

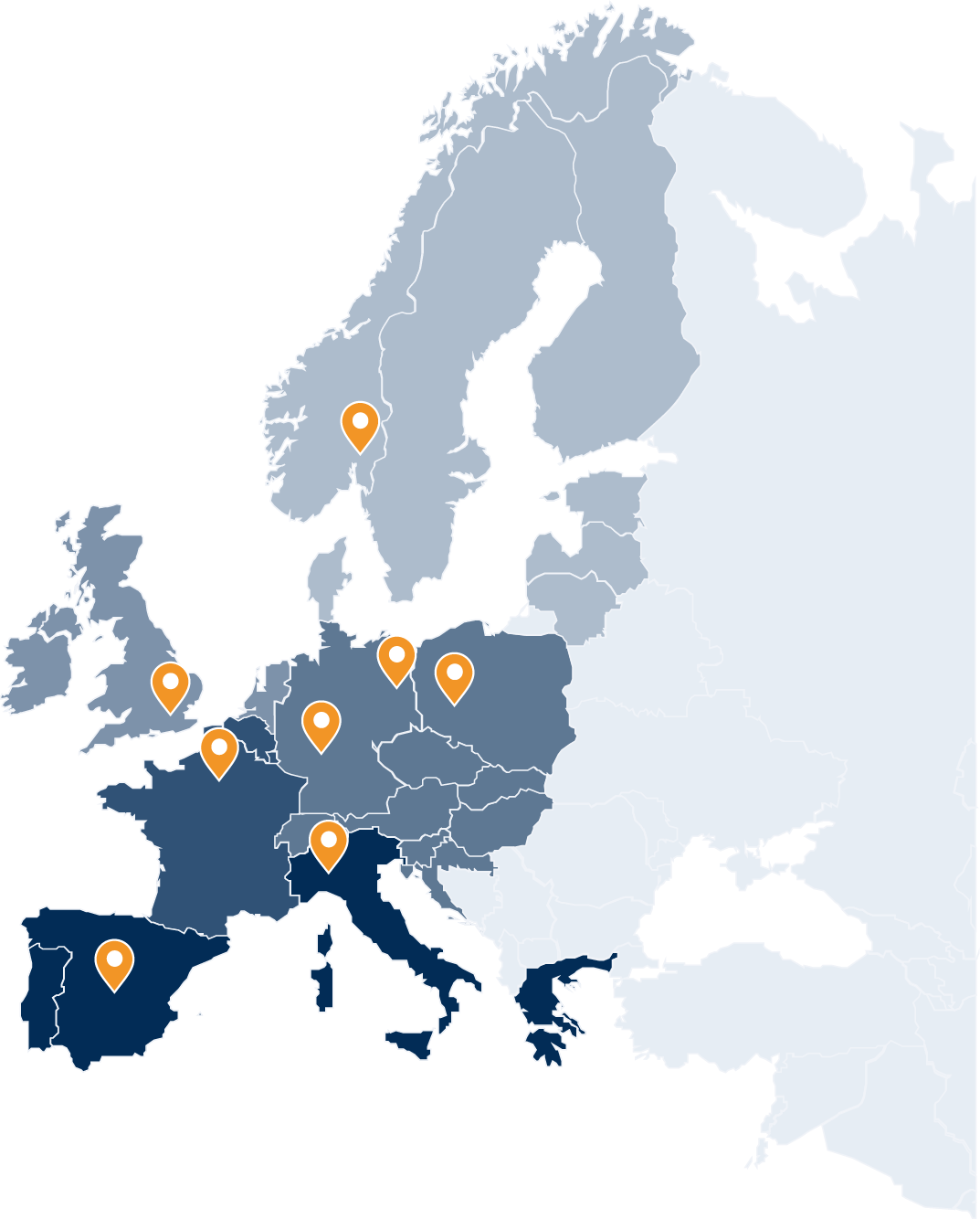

About Scope’s ratings: Scope is Europe’s largest rating agency, covering all major issuer and credit market segments and operating from several offices across the region. Scope offers a distinct European perspective on credit risk and provides credit analyses rooted in the European context, by taking into account relevant local financial, political, regulatory, legal and cultural factors. Scope’s ratings therefore offer investors greater diversity of opinion than the homogenous analysis of US rating agencies. Importantly, Scope’s ratings have historically exhibited less ratings volatility in crisis and stressed economic environments.

About Scope’s ratings coverage: The universe of European issuers rated by Scope includes more than 10,000 bonds with an aggregate volume of around EUR 23trn. According to ESMA CRA Market Share Report 2023 edition, Scope has the second largest ratings coverage for public-sector issuers and the third largest for non-financial corporates in Europe. In addition, Scope rates many debt issuers that are not rated by any other rating agency. On-boarding Scope therefore increases investors’ investible universe.

About the acceptance of Scope’s ratings: Scope has been registered as an External Credit Assessment Institution (ECAI) by EU supervisors for more than 10 years. Scope Ratings is the only European rating agency that the ECB has accepted in the Eurosystem Credit Assessment Framework (ECAF). With ECAF acceptance, investors can use Scope’s credit ratings to fulfil the credit-quality requirements of marketable assets that are eligible as collateral in Eurosystem monetary policy operations.

European Rating Agency & Capital Markets Union: Europe’s policy makers have long recognised the region’s need for its own strong, independent rating agency, a view given extra urgency by the global financial crisis of 2008 and the European sovereign debt crisis of 2011. The crises exposed Europe’s vulnerability in the realm of credit ratings, with issuers – governments, banks, corporates – and investors reliant on credit opinions of the oligopoly of North American credit rating agencies (CRAs). Jean Claude Trichet, former President of the European Central Bank, reiterated this call at the launch of the Scope Foundation in 2020 when he said: "Europe needs a strong and independent European rating agency.” (See also: Foundation secures Scope's European identity). Enhancing Europe’s financial sovereignty and establishing a European rating agency has recently gained even further importance as creating the capital markets union has risen up the political agenda.

More news on Scope Group: